Measuring Nature in the Supply Chain

The supply chain is where most nature-related risks and opportunities lie, yet it remains one of the most challenging areas for businesses to measure...

The heterogenous character of nature complicates the measuring of nature-related dependencies, impacts, risks and opportunities in a supply chain. Knowing where commodities in your supply chain have been produced or extracted is essential when measuring nature.

Current supply chain analysis frequently uses aggregated data summarised at country or regional scales. While these help prioritise issues, the insights are too coarse for companies looking to drive nature positive actions in their supply chain.

So we’re working hard to bridge the gap! We believe that companies shouldn’t have to choose between inaction and impossible data demands. We’re building a robust and scalable method to give companies insights they can act on, even with limited data.

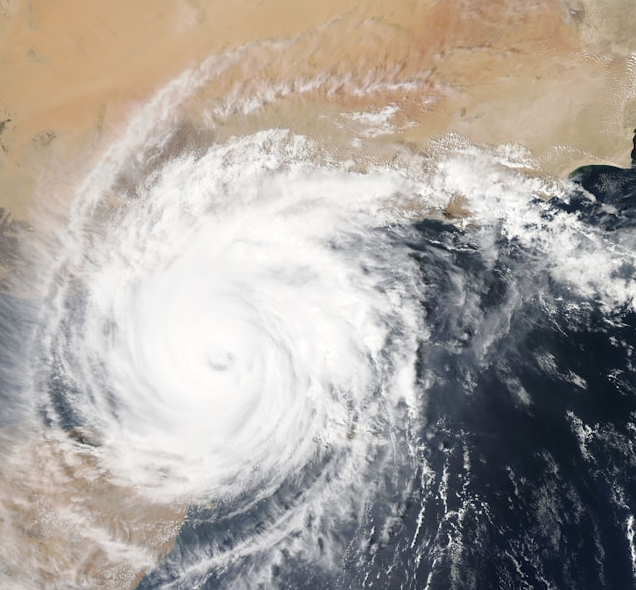

The condition of ecosystems, the severity of water stress and the presence of biodiversity can vary dramatically, even within the same country or region. A river basin under severe water stress might lie next to one in relative abundance. A biodiversity hotspot can sit just miles from an intensively farmed landscape. Nature doesn’t follow national borders, and its variation can’t be averaged away.

Example 1: The country-level blind spot

Imagine a global company trying to reduce water-related risks across its supply chain. It sources from tens of thousands of farms worldwide. To prioritize efforts, it ranks countries by their average water stress. France scores as “Medium”.

But this misses a crucial detail: the farms supplying the company are located in Western France — an area experiencing Very High water stress.

Because the insights are coarse, the company can’t confidently say whether or not its farms in France face water risks. As a result, it may choose not to engage with those farms, which would expose it to risks such as disrupted supply or product shortfalls.

Regional data is better than country data. But it also can be limited.

For example, consider a company sourcing soybeans from the USA. It wants to understand whether to put in place measures to protect biodiversity. So it creates average biodiversity intactness scores for all the states it sources from. The results suggest Arkansas has good biodiversity intactness.

However, almost all soy farming in Arkansas happens in the eastern part of the state, an area with lower biodiversity than the state average. Meanwhile, the more biodiverse western region isn’t involved in soybean production at all.

Once again, the company cannot confidently act. In this case, it cannot state whether it should, or should not engage with soybean suppliers in Arkansas, so it may be incorrectly de-prioritised.

At Natcap, we’re focused on building that missing middle ground: solutions that go beyond country- or region-level generalizations but don’t require full site-level data for every supplier.

We sample likely production sites within regions, for example, using crop maps. This allows us to run our site level metrics such as biodiversity intactness or ecosystem fragmentation. Using site metrics allows us to:

The supply chain is where most nature-related risks and opportunities lie, yet it remains one of the most challenging areas for businesses to measure...

Nature-related risks in supply chains are increasingly recognised as material threats to business stability and reputation. For most companies the...

For most organisations, the largest impacts on nature occur not within their own operations but across their upstream supply chains. Yet many are...