Nature Reporting & Sustainability in 2026: From Early Movers to Market Standard

If 2025 was the year nature moved from a “grey zone” of discourse to a business and regulatory imperative, then 2026 will be the year the question...

3 min read

Marc Kennedy

:

Updated on November 4, 2025

Marc Kennedy

:

Updated on November 4, 2025

The Taskforce on Nature-related Financial Disclosures (TNFD) released its latest status report as part of Climate Week NYC 2025, and the findings highlight a decisive shift: nature is building momentum alongside climate in corporate and financial reporting. The report demonstrates that nature-related risks and opportunities are becoming central to how organisations think about financial performance, resilience, and long-term value creation.

As regulatory requirements expand and investor pressure intensifies, businesses face both risks and opportunities. The TNFD status report offers a comprehensive snapshot of where the market stands - who is reporting, how adoption is unfolding, and what gaps remain. This moment represents a tipping point for nature-related disclosure, one that will shape both compliance strategies and investment flows over the coming years.

Two forces are the dominant drivers of nature-related reporting: regulatory pressure and investor expectations.

69% of investors surveyed are concerned about the impact of nature loss on financial markets (56% very, 42% somewhat)

98% of investors surveyed are concerned about the impact of nature loss on financial markets (56% very, 42% somewhat)

Regulatory pressure: On the regulatory front, almost 70% of organisations surveyed by TNFD already face or expect to face sustainability reporting requirements in the next three years. Europe and Asia are under the greatest short-term pressure, with over 70% of businesses in both regions anticipating regulatory obligations. These findings underline that disclosure is no longer a matter of corporate choice. It is increasingly a legal requirement.

Investor expectations: At the same time, investors are raising the bar. Over 50% of investors surveyed said they are ‘very concerned’ about the impact of nature loss on financial markets, while another 42% are ‘somewhat concerned’. Nature is firmly on the financial risk radar. Importantly, a majority of investors rank nature among their top three sustainability topics, with deforestation, biodiversity, and fresh water emerging as priority issues for corporate engagement.

Investors are also calling for stronger global standards. 71% want the International Sustainability Standards Board (ISSB) to launch a dedicated standard for nature, biodiversity, and ecosystem services. An even larger majority - 91% - agree that the ISSB’s framework should adopt or incorporate the TNFD recommendations.

Implication: Regulatory and investor pressure are already the most powerful drivers of adoption. This pressure will continue to grow, pushing nature-related disclosures into the financial mainstream.

The report shows impressive momentum behind TNFD adoption, but also significant unevenness in how it is being implemented.

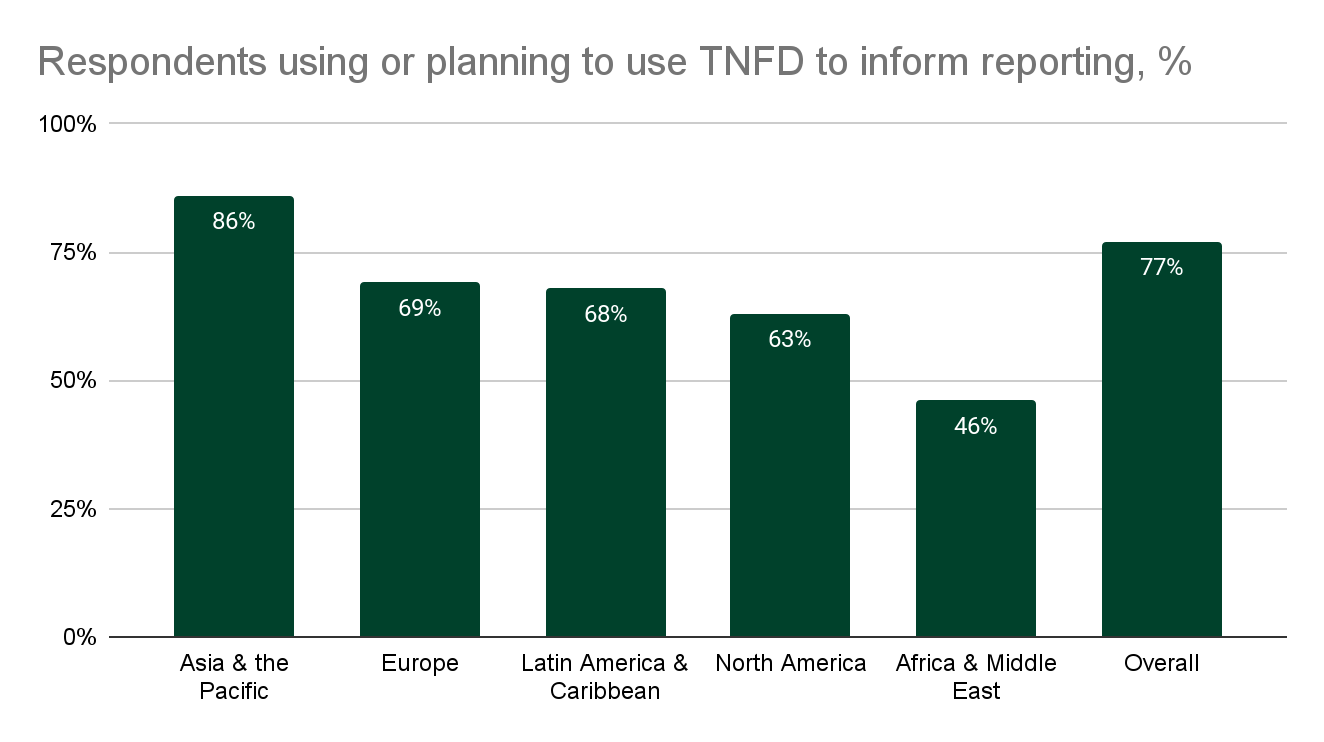

Overall, 89% of respondents have already reported or plan to report nature-related information, and 77% are using TNFD guidance to shape their disclosures. More than 500 TNFD-aligned reports are now publicly available, and thousands of companies are already reporting nature-related metrics such as water and waste through platforms like Bloomberg.

Regional differences are notable. Adoption is strongest in the Asia-Pacific region, where 86% of organisations are already engaged with the TNFD. Europe, Latin America & Caribbean, and North America follow at 69%, 68% and 63% respectively, while Africa and the Middle East lags at 46%.

The quality of disclosure is also uneven. Governance and risk management disclosures are relatively strong, reflecting the areas where organisations find it easiest to integrate nature into existing frameworks. However, metrics, targets, and scenario analysis remain underdeveloped, highlighting the challenge of translating ambition into measurable performance.

Implication: Momentum is undeniable, but the unevenness of disclosure makes comparability difficult and risks undermining investor confidence unless addressed.

A consistent theme in the status report is that data availability and methodological challenges remain a major barrier.

Metrics on drivers of impact are more straightforward. These are often metrics companies are used to reporting, such as waste generation, water withdrawal, and wastewater discharge. However, metrics on the “state of nature” are more challenging. For example, companies report difficulties in assessing species extinction risk, ecosystem condition, and invasive species.

Market evidence also reveals fragmentation. Bloomberg, Goldman Sachs, and Net Purpose all track nature metrics differently, and coverage varies significantly. This lack of consistency makes it hard for investors to compare disclosures across companies and sectors.

Implication: Closing data gaps and improving feasibility are essential for TNFD adoption to become decision-useful for markets. Without better methodologies and greater alignment, the quality of disclosures risks lagging behind the demand for them.

The report highlights a strong desire for greater standardisation and mandatory reporting. Investors overwhelmingly back the ISSB to play a central role, adopting TNFD into a global baseline for nature disclosures. This would mirror the trajectory of climate reporting, where TCFD laid the groundwork for ISSB standards.

Crucially nature and climate are interlinked, and we are already seeing disclosers make that connection. 33% of survey respondents stated that they published their nature-related report in a standalone corporate sustainability report that was integrated with climate and social disclosures, and another 33% integrated their nature-related report with mainstream financial disclosures and climate-related disclosures. Only 17% published it in a standalone TNFD report. It’s likely that the trend towards integrated reporting will continue.

For businesses, this transition represents more than compliance. Early adopters of the TNFD will be better positioned to build investor trust, strengthen resilience, and capture emerging opportunities in nature-positive finance. Companies that delay may find themselves playing catch-up as investor expectations and regulatory obligations converge.

The TNFD 2025 status report marks a turning point. Nature-related disclosure is no longer a “nice-to-have” - it is becoming a mainstream financial issue, shaped by regulatory mandates and investor demand.

Adoption is strong, but uneven. Data gaps remain, especially in measuring biodiversity and ecosystem impacts. Yet the direction of travel is clear: towards mandatory, standardised, and globally harmonised reporting.

For companies, the call to action is simple. Embrace TNFD early, strengthen data capabilities, and treat nature-related risks and opportunities with the same urgency as climate. Doing so will not only meet compliance but also position businesses to thrive in a financial system where nature is firmly on the balance sheet.

If 2025 was the year nature moved from a “grey zone” of discourse to a business and regulatory imperative, then 2026 will be the year the question...

For companies in the food and agriculture industry, nature-related reporting is becoming increasingly complex. With multiple frameworks (TNFD, CSRD,...

In February, the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) approved its Business and Biodiversity...